Quick reference for brokers

General Information

-

Company Background Information

Company background provides information about Foyer Group. More information can be found on our corporate website. For more information, please check https://groupe.foyer.lu/en/foyer

Foyer Group

Since its foundation in 1922, Foyer Group has been a key player in the economic and financial landscape of Luxembourg. Leader of the local insurance market since its inception, it is now present in several European countries through its three businesses: insurance, protection, and wealth management.

The keys to this strength and longevity lie in the stability of family ownership and in Foyer Group’s strong local roots.

Past, present and future are combined in the culture and values of Foyer Group. Its mission, its development and its projects are geared towards the future.

Our Mission

“To become a leading player in the financial sector.

François TESCH, Chief Executive Officer

Since its foundation, the Foyer Group has become Luxembourg’s primary insurance provider thanks to its unerring ability to listen and respond to its customers’ needs. Today, the European Union poses many new challenges while at the same time opening a host of new opportunities.

The Group’s mission is to strengthen its leading position on the domestic market while expanding its financial sector services and developing its niche business beyond Luxembourg’s borders. To succeed in this mission, the group makes use of Luxembourg’s many advantages within this European framework.”Our Values

A business cannot exist without its employees, the men and women who share a business culture based on a set of common values.

The five key values on which the Foyer culture is based are:

Trust: we do what we say and we say what we do

Excellence: we constantly strive to respond to our clients’ needs

Innovation: we set ourselves challenges

Integrity: we lead by example

Independence: we take responsibility

Our Histroy

1922: Le Foyer, Compagnie Luxembourgeoise d’Assurances S.A. is founded.

1924-1925: Le Foyer expands its activities into France and Belgium.

1982: Le Foyer France is sold to Le Secours.

1986: Europ Assistance Luxembourg is founded. Its shareholders are Europ Assistance France (51%) and Le Foyer Assurances (49%).

1990: The Le Foyer Group is born (as a subsidiary of Le Foyer Finance) following the demerger of Le Foyer, Compagnie Luxembourgeoise, which resulted in the foundation of Le Foyer Assurances and Le Foyer Vie, non-life and life insurance companies respectively.

The Belgian business is sold to Royale Belge.

1992: The group acquires a large shareholding in “BIL-Participations” (subsequently renamed “Luxempart”).

1996: Creation of Foyer International S.A.

1997: Creation of Foyer Asset Management.

1998: Le Foyer S.A., the group’s future pole of development for its insurance and asset management businesses, is created.

1999: Creation of Le Foyer Santé.

2000: Le Foyer S.A. is listed on the Luxembourg and Brussels stock exchanges.

2005: The company name changes from Le Foyer S.A. to Foyer S.A.

2006: The group’s registered office moves from Luxembourg-Kirchberg to Leudelange.

2008: Foyer Patrimonium and Foyer Asset Management merge to form Foyer Patrimonium S.A.

Foyer Assurances’ transfer of its interest in Europ Assistance Luxembourg to Europ Assistance Belgium.

2009: The Foyer Group acquires the CapitalatWork Group.

2010: Creation of La Réassurance du Groupe Foyer S.A.

2011: Foyer Assurances sold its reinsurance captive company Foyer Re S.A. to a French industrial group.

2012: Foyer celebrates its 90th anniversary

2014:

– Foyer launches its “Global Health” coverage: health insurance tailored to the needs of expatriated workers

– Life Insurance: acquisition of International Wealth Insurer’s group insurance portfolio

– Foyer launches a normal course issuer bid (NCIB) and acquires 83% of shares held by the public

– From 1 November, the Group is leaving the Luxembourg and Brussels stock exchanges to become an unlisted company.Sustainable Development

CSR label awarded – 25 September 2012

The Foyer Group has been awarded the “Socially Responsible Company” label by the INDR (French National Institute for Sustainable Development and Corporate Social Responsibility).

Foyer is the first insurance company among the 60 companies to have received the label to date.

There are three pillars to sustainable development in the corporate world:

Social: social consequences of the company’s activity on all stakeholders: employees, suppliers, customers, local communities and civil society.

Environmental : compatibility of the company’s activity with preservation of ecosystems, analysis of the impacts caused by the company and its products in terms of consumption of resources, production of waste, pollution, etc.

Economic : financial performance as well as capacity to contribute to the economic development of the company’s local community and stakeholders, compliance with the principles of fair competition.

In January 2009, the Foyer Group concluded a partnership agreement with the non-profit organisation MyClimateLux.

MyClimateLux activities are aimed in particular at making companies and the public at large aware of climate change, the efficient use of energy and renewable energy sources, together with enabling the voluntary compensation of CO2 emissions by investing in high-quality climate protection projects.

Offsetting the CO2 emissions of Foyer clients

At the 2009 car show, the Foyer Group continued to raise awareness among its clients by taking concrete action: for a period of one year, Foyer undertook to offset the CO2 emissions of each new car insured with mobilé between 30 January 2009 and 31 May 2009.

By taking this step, Foyer hoped to set an example and motivate everyone to reduce their greenhouse gas emissions and offset residual emissions. 11,225 tonnes of CO2 were offset via the purchase of certificates from MyClimateLux. The funds paid by Foyer to MyClimateLux were used to finance the construction of efficient ovens in Peru which help to cut the need for wood, reduce the environmental impact and improve living conditions for the local population.CSR Label

CSR ACCREDITATION : “FOYER WANTS TO ENSURE A BETTER FUTURE”

Foyer is always looking for ways to improve. The company met the criteria of the Luxembourg Sustainable Development and Corporate Social Responsibility Institute (INDR) and was therefore able to renew its “Socially Responsible Company” accreditation in September 2015 for a period of three years.

Of the 100 companies that have received the accreditation so far, Foyer is the only insurer to have obtained and renewed its certification .This award is a testament to the Group’s commitment to CSR.

In the corporate world, sustainable development comprises three pillars:Social: social consequences of the company’s activity on all stakeholders: employees, suppliers, customers, local communities and civil society.

Environmental: compatibility of the company’s activity with preservation of ecosystems, analysis of the impacts caused by the company and its products in terms of consumption of resources, production of waste, pollution, etc.

Economic: financial performance as well as capacity to contribute to the economic development of the company’s local community and stakeholders, compliance with the principles of fair competition.

CSR Committee

Foyer Group has also created a committee that meets on a regular basis to structure, formalise and develop the Group’s CSR approach, with a view to creating shared values. -

Discover our Strengths

Foyer Global Health stands for an excellent insurance cover, which has been created due to decades of experience and developments with customers from all over the world. Our company is located in the Grand Duchy of Luxembourg and thus in one of the most important centers for global and cross-border companies. Those bullet points should help you and your customers to highlight the advantages of Foyer Global Health.

As a Company

- Consistency: We are part of the Foyer Group and fully independent; we are our own underwriter.

- Professionalism and Flexibility: ”Made in Luxembourg” …, everything is done by our own teams and departments.

- Expertise: Many years of expat experience “Problem solver”

- Efficiency: Short decision-making paths, decisions are made quickly and efficiently.

- Simplicity: For conclusions and new applications

- Transparency: Fair and transparent pricing approach

- Partnership: We act as partner and consultant

Foyer Global Health – Individual Business

- Integration into the Foyer Global Health network (exchange between customers)

- Wide range of products for individual customers.

- Innovative and progressive partnerships: Europ Assistance, Teladoc Health …

- Combination of different individual and customized product modules for each family memberPersonalized access to the portal.

Foyer Global Health – Corporate Business

- Integration into the Foyer Global Health network (exchange between customers)

- Wide range of products for corporate customers

- Innovative and progressive partnerships: Europ Assistance, Teladoc Health, HDI…

- Individual online solutions

- Maintain insurance coverage in case of a necessary change from a group contract to an individual contract.

- Personalized access to the portal

- Flexible group contracts – modified and adapted (or adjusted) to the individual requirements and needs of the customers.

- Inclusion of pre-existing conditions without risk assessment in the mandatory group contract.

- Inclusion of pre-existing conditions with risk assessment in the facultative group contract possible.

- Some waiting periods can be omitted.

-

Contact Information

Individuals

Questions about expat health insurance individual plans, pricing, cover and benefits:

- Email:onlinesales@foyerglobalhealth.com

- Phone:+352 437 43 4256

- Address: 12, rue Leon Laval, L-3372 Luxembourg

Group contracts

Questions about expat health insurance for groups, pricing, cover and benefits:

- Email:sales@foyerglobalhealth.com

- Phone:+352 437 43 4245

Policy

Questions about registration/deregistration, application procedures, policies and invoicing:

- Email:policy@foyerglobalhealth.com

- Phone:+352 437 43 4244

Claims

Questions about service processes and claims:

- Email:claims@foyerglobalhealth.com

- Phone:+352 437 43 4244

-

FGH Benefits

Benefits

The following section will help to navigate and compare the benefits offered by the Foyer Global Health packages.

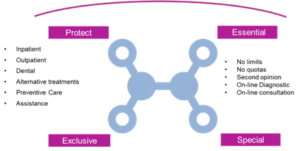

Individual Insurance Cover Key Characteristics

We have designed coverage packages to offer standard broad range of benefits that includes Inpatient, outpatient, dental and assistance.

- Comprehensive insurance: inpatient, outpatient, dental treatment, medical and additional assistance

- Chronical diseases and congenital conditions

- No pre-authorization requested to start treatment

- (except psycho- & speech- therapy, inpatient rehabilitation follow-up, home nursing and domestic assistance)

- No overall limit per insurance, even in case of critical illness

- Second opinion

- Telemedicine

Scope of benefits details

Detailed benefits table and tools:

Scope of Benefits EXCLUSIVE SPECIAL ESSENTIAL

Scope of Benefits EXCLUSIVE

Scope of Benefits SPECIAL

Scope of Benefits ESSENTIAL

URL

You can also scroll through the different benefits using our website

FAQ

My clients are relocating to Japan and are planning to have a baby. What coverage would you suggest?

First, please advise your client that the maternity cover is included in our SPECIAL and EXCLUSIVE covers. In the case of Japan, in our experience, the costs linked to maternity can be excessive, therefore we would strongly recommend your client to apply for EXCLUSIVE cover which grants up to 20.000€ for maternity costs. Please note the applicable waiting period of 10 months.

Are there any waiting periods?

There are generally no waiting periods except for maternity (10 months), major dental treatments (10 months) psychiatric (10 months) and infertility treatments (24 months). Waiting times apply as from date of subscription.

What are the limits applicable to the benefits?

First, there are generally no limits for inpatient costs, which is one of the main advantages offered by Foyer Global Health. Other limits apply to outpatient treatment, depending of the treatment. All the limits are clearly visible in the benefits section available on our website, in the scope of benefits or the broker landing page.

Deductibles: how does it work?

First, please note that any selected deductibles only apply to outpatient costs. The deductibles are calculated per year (12 months) and per person.

My client is looking for hospitalization (in-patient) coverage only. What would you suggest?

We would strongly suggest applying for our comprehensive coverage. Your client can apply for a deductible (0, 250, 500, 1000 €), which will reduce the premium whilst maintaining outpatient treatment coverage above the selected deductible amount. Please remember that deductibles only apply to outpatient costs, which therefore has no impact on in-patient (hospitalization) costs.

-

Landing Page

Foyer Global Health offers its broker partners the development of a free exclusive web page available to the broker’s clients, through their website.

Why?

There is an increasing demand from clients seeking IPMI solutions available on the web. New generations are often eager to access information via their smartphone or laptop.

Subscriptions can be done quickly, smoothly and easily on-line, without the hassle of signing documents and papers. For expat clients who have often already left their country when seeking IPMI coverage, the landing page will enable the broker to advise their clients efficiently.

This tool allows general brokers who are not necessarily familiar with the specificities of IPMI to demonstrate their ability to provide additional solutions and specialization.

The landing page provides a dedicated space with easily accessible up-dated information.

The landing page enables easy-to-use tools that removes lots of the administrative hurdles both for the broker as for the client.

The landing page is managed by Foyer Global Health, whilst the broker controls all interactions between the client and the page.

The client can request a quote to be sent to his personal email address, as well as subscriptions can be completed on-line.

For any subscriptions through the broker’s page, copies of documents are automatically copied to the broker, and commissions are automatically added to his account.

Landing page is freely available to all our registered partners and brokers. There is no volume commitment requested to benefit from this opportunity.

Our systems are programmed by default to restrict any inputed information by broker’s client through the landing page to be accessible to Foyer

Landing pages are available in English, German and French.

How does it work?

We invite you to visit our demo landing page available here.

By entering his date of birth, the client can obtain

- quoting tool: specific pricing grid

- easy premium calculation

- benefits/solutions comparator

- on-line subscription

- up-to-date information about FGH products available on-line

- How to obtain a broker landing page

Once we receive the information and material, up to 48 working hours are necessary to create the page.

The following link provides a sample of a landing page : Rise Broker

- Individual visitor trafic statistic on-line report available to broker via Google analytics

- LP available in 48 hours after receipt of information (colors, logo, references, pictures, text)

- If colors or photos available not available by broker, FGH can provide

Information and Material

- Provide a URL where the page will be displayed

- Define which language(s) should be made available (DE – EN – FR)

- Introduction text: +/- 150 words (for the selected languages)

- 1st & 2nd Pictures (behind the introductions & before the quotation tool): 1841×717+1841×544

- Broker’s quote: 15-25 words*

- Broker’s e-mail, website & phone number

- Broker’s address for the map

- Broker’s logo

- Broker’s main color (otherwise we pick a color from the logo)

- Content for emails sent to people asking to receive their quote by email (selected language

Please refer to the demo landing page for references to the aforementioned needed material/

Sales Process

-

Eligibility

With the broad range of different covers provided by Foyer Global Health, you may find it daunting to know, who exactly is eligible for a specific cover. This short guide will help you determine eligibility of your prospect.

Categories of insurance cover

Eligibility is mainly determined by the category of the insurance cover. We distinguish the following categories:

- International Private Medical Insurance

- Medical Insurance for EU civil servants

- Medical Insurance for French residents working in Switzerland

Please consult Available Insurance Covers for an overview of the covers in the different categories

General Exclusion

People who are permanent residents in the United States are excluded from insurance cover.

If an insured person takes up permanent residence in the United States, the insurer will terminate the insurance relationship. In the event of moving to any other country, the insurer may on a case-by-case basis, even during an ongoing insurance relationship, check that this policy complies with national law and according to the results, decide whether insurance cover can be maintained or else needs to be modified or terminated.

International Private Medical Insurance

All people who are temporarily abroad, while temporarily does not mean short term. There must be an indication, that a return to the home country is planned or foreseeable. This could be after months or many years.

Essential, Special and Exclusive require a minimum subscription duration of 3 months.

Protect allows a minimum of a 1-month duration, with a maximum of 12 months.

Please consult our best practice guide Essential vs. Protect to advise your customer best.

Some examples are: Long term assignment of employee and family, ERASMUS students, project managers on short term assignment, specialised workers on international contract. In doubt, please get in touch with us. Click here if you need to access our contact data.

Medical Insurance for EU civil servants

All people covered by the JOINT SICKNESS INSURANCE SCHEME (JSIS) of the European Institutions.

Please note that some people may refer to the JSIS as RCAM, which is the French denomination of the JSIS

Medical Insurance for French residents working in Switzerland

Only the policyholder who is validly affiliated with the compulsory health care insurance in accordance with the Federal Law on Health Insurance in Switzerland and who does not reside in Switzerland may benefit from the guarantees of the contract. He himself must be insured under the policy. All persons related to the policyholder, spouse, partner, or dependent children, may be insured with the policyholder.

-

Brochure Library

You will find below all the material and documentation. Please do not hesitate to call your sales manager for any specific information or details that may not find in the library

Sales Brochures

GLOBAL HEALTH: Product brochure-EN

EPION: FGH-Product Brochure EPION-EN

EU HEALTH : FGH-Product Brochure EU Health-EN

General Conditions

General terms-EN

Special Conditions

SPECIAL CONDITIONS_ESSENTIAL_EN

SPECIAL CONDITIONS_ESSENTIAL_incl assistance conditions-EN

SPECIAL CONDITIONS SPECIAL-EN

SPECIAL CONDITIONS incl assistance-EN

Marketing (Welcome Package, Brochure…)

Additional marketing material is provided by our sales support team. If you need brochures, flyers or other sales tools, do not hesitate to contact our team.

-

Prices

Tariff levels / Deductible

The Foyer Global Health individual insurance is divided into the tariff levels: Essential, Special and Exclusive.

The individual tariff levels differ according to the type and amount of the agreed services.

The complete scope of benefits is listed and explained in the special conditions.

In addition, there are the following variants of a deductible:

For Foyer Global Health Essential, Special and Exclusive the following self-service levels can be selected:

- Excesses of € 0, € 250, € 500 or € 1,000

The excess applies per insurance year and per insured person and only in the case of expenses for insured outpatient treatment.

Target Region

The insurance cover applies to the following target regions:

- Target region 1: Worldwide

- Target region 2: Worldwide without USA

If insurance cover exists for destination region 2, insurance cover for temporary travel (i.e. for a maximum of six weeks) to destination region 1 applies only to medical emergencies, consequences of accidents and death.

Travel for the purpose of medical treatment to a destination not agreed upon is not covered.

A change in the country of residence of an insured person must be notified immediately, as this change may affect the premium.

If insurance cover has been agreed for target region I, the maximum insured rates, e.g. for dental prostheses, are doubled, as are flat rates, e.g. for visual aids.

If a benefit is limited to a certain number of days or measures, this limitation shall continue to apply unchanged. Any agreed deductible also remains unchanged.

Price List (PDF)/Premiums

-

Quotation

Good and accurate offers/quotations are essential parts of the business. You must be able to send regular offers to customers within the shortest possible time.

We distinguish between two methods for the preparation of quotations:

Corporate customers

You must return the corporate checklist (see link) to our sales team. In addition, we need a list of the persons to be insured (name, first name, date of birth, country of departure…) Once we have received this information, we can create a customized quote.

Individual customers

In principle, it is sufficient to consult your premium table and to include the prices in your offer. If you need a specific offer layout, we can also provide it to you. In addition, our online calculator (link) is a good way to make a regular and attractive offer for your customers.

As you can see, the possibilities are manifold. If you have any further questions, do not hesitate to contact us directly (contact link Sales Support).

Application Process

-

Application

The application is the first step towards the new insurance. The more precise and detailed the application is filled out, the faster and more effectively the application can be processed.

Processes and Documents

You can send applications in the following forms:

Document (PDF)

You should have this document carefully completed and signed by the customer. Many fields must be filled in (e.g. personal data, health issues…)

Online Application

The information can be entered completely in the online form. The application form is no different from the PDF version.

The more detailed and complete you send us the application, the faster and more reliable the application can be processed by our policy department.

Once we have received all the necessary information and documentation, applications are usually processed within 5 working days.

Important documents

To process the application and verify the identity of the clients, we need the Identity card and/or passport for every single insured person. In case of a new born a birth, certificate will be enough.

Sepa payment

In case of Sepa payment, please fill out the formula or add your own sepa mandate.

Credit card payment

In case of credit card payment, the client will receive a link where he will have to register his credit card. Please note when he registers his credit card, it is just a reservation and constitutes 2-month payment. We can only generate the insurance documents when the client has entered his credit card. The broker will not receive a copy of the link and no notification.

Payment frequencies

Different frequencies can inquire a premium increase, please view application form for more information.

Additional information

any additional information that you can provide to give a clearer picture on the health status of the prospect can be added as PDF File.

Please note that we have a limit of 5mb in email attachment capacity. Please send your documents below 5mb.

Insurance documents

Insurance documents are being sent out by the sales support team to the broker unless convened differently. This gives the brokers the possibility to review the documents before sending on to the client.

Cancellations

Cancellations of a client must come directly from the broker, if the client send us a request of cancellation, the client will be asked to inform there broker and the broker will have to inform us about the cancellation request.

-

Questionnaires

The questionnaires allow us to make a deeper analysis of the customer’s request.

For new applications, clients must complete a medical questionnaire informing us of their health, including treatments they have undergone, medication, eyes and teeth information.

Based on the data provided by the client, the contract department relies on the medical advice of our in-house doctors to determine whether exclusions or surcharges should apply in certain cases to the client.

For this we send an additional medical questionnaire to the client in order to better understand the conditions, diseases or disorders that are involved (cardiovascular, gout, hypertension, medication, hernia…)

Regardless of conditions, disorders, etc., the supplementary medical questionnaire includes at least 13 questions regarding the cause, consequence, diagnosis, name of treatment, duration of treatment.

Additional questions may be asked depending on the disorder (e.g. cardiovascular/tension measurement, cardiac examination report to be sent)

Reimbursement process

-

Claims

Introduction

When it comes to filing a claim, we strive to make the lives of your client as smooth as possible.

This module will guide you on the Claims process. How to file a claim? What information do we need? Whom to contact? How to track a claim?

Due to strict privacy and compliance policies, any communication regarding claims will be handled directly with your client. We generally will not allow brokers to file or treat claims on behalf of his/her client for this matter. Indeed, claims reimbursements and the related benefit statement contains details that are privileged to the client. Benefit statements are therefore strictly sent only to the personal client’s email reported during the application.

However, general information about claims reimbursements are available on the portal, which allows you to check when benefits are paid.

Filing a claim: What information do we need and why?

For our claims team to analyze the validity of claims and to rapidly process reimbursements, we need the following information:

- Original invoice is needed to determine the amount(s) claimed, and for which treatment. An electronic copy of the original invoice

- With the invoice, we need a valid diagnosis reported by the treating doctor. Based on the diagnosis, the claims team will assess if the treatment is covered under the client’s selected plan and apply limits or exclusions, where needed.

- Mail and its pdf attachments should be sent to claims@foyerglobalhealth.com

- Clients may also file claims using the portal

If the client has selected deductibles (only applicable to outpatient costs) as part of the plan, client should file all covered costs, even though he/she may not be eligible to reimbursement under the deductible conditions. Illegible costs will be reported and treated by our systems accordingly, allowing eligible claims to be reimbursed upon reaching the deductible amount.

Reimbursements

Once we have received all the necessary information and documentation, claims are usually processed to allow reimbursements to be paid within 7 working days.

All wire transfer costs are covered by Foyer Global Health. However, some banks will charge internal process fees which may not be claimed to Foyer Global Health.

How to file a claim: procedure

Clients have several means to submit a claim, either by using their portal, or sending an email with all relevant information (see above: Filing a claim: What information do we need and why).

General claims procedure can be found here (EN-Guide How to claim)

Treatment Pre-approval

As defined in the Scope of benefits, some treatments require pre-approval. To request for pre-approval, your client will need to contact the Claims department (see Contacts).